omaha ne sales tax rate 2019

Did South Dakota v. The Nebraska sales tax rate is currently.

2020 The Year Of The Roth Ira Conversion Lutz Financial

Omaha collects the maximum legal local sales tax The 825 sales tax rate in Omaha consists of 625 Texas state sales tax 05 Morris County sales tax and 15 Omaha tax.

. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. The Nebraska state sales and use tax rate is 55 055. Local sales and use tax increases to 2 bringing the combined rate to 75.

Sales Tax Breakdown Omaha Details Omaha NE is in Douglas County. Nemaha is in the following zip codes. The Omaha Nebraska sales tax is 700 consisting of 550 Nebraska state sales tax and 150 Omaha local sales taxesThe local sales tax consists of a 150 city sales tax.

For tax rates in other cities see Texas sales taxes by city and county. The following sales and use tax rate changes will take effect in Nebraska on January 1 2017. There is no applicable county tax or special tax.

The December 2020 total local sales tax rate was also 5500. May 26 2019. This is the total of state county and city sales tax rates.

2 combined rate of 75 Weeping Water. The County sales tax rate is. 15 combined rate of 7 Wilber.

You can print a 825 sales tax table here. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Sales Tax Breakdown Nemaha Details Nemaha NE is in Nemaha County.

With local taxes the total sales tax rate is between 5500 and 8000. Edward 07012019 15 0101200910 St. This is the total of state county and city sales tax rates.

You can find more tax rates and allowances for Omaha and Nebraska in the 2022 Nebraska Tax Tables. Omaha collects the maximum legal local sales tax The 8 sales tax rate in Omaha consists of 4 Georgia state sales tax 3 Stewart County sales tax and 1 Special tax. 2020 rates included for use while preparing your income tax deduction.

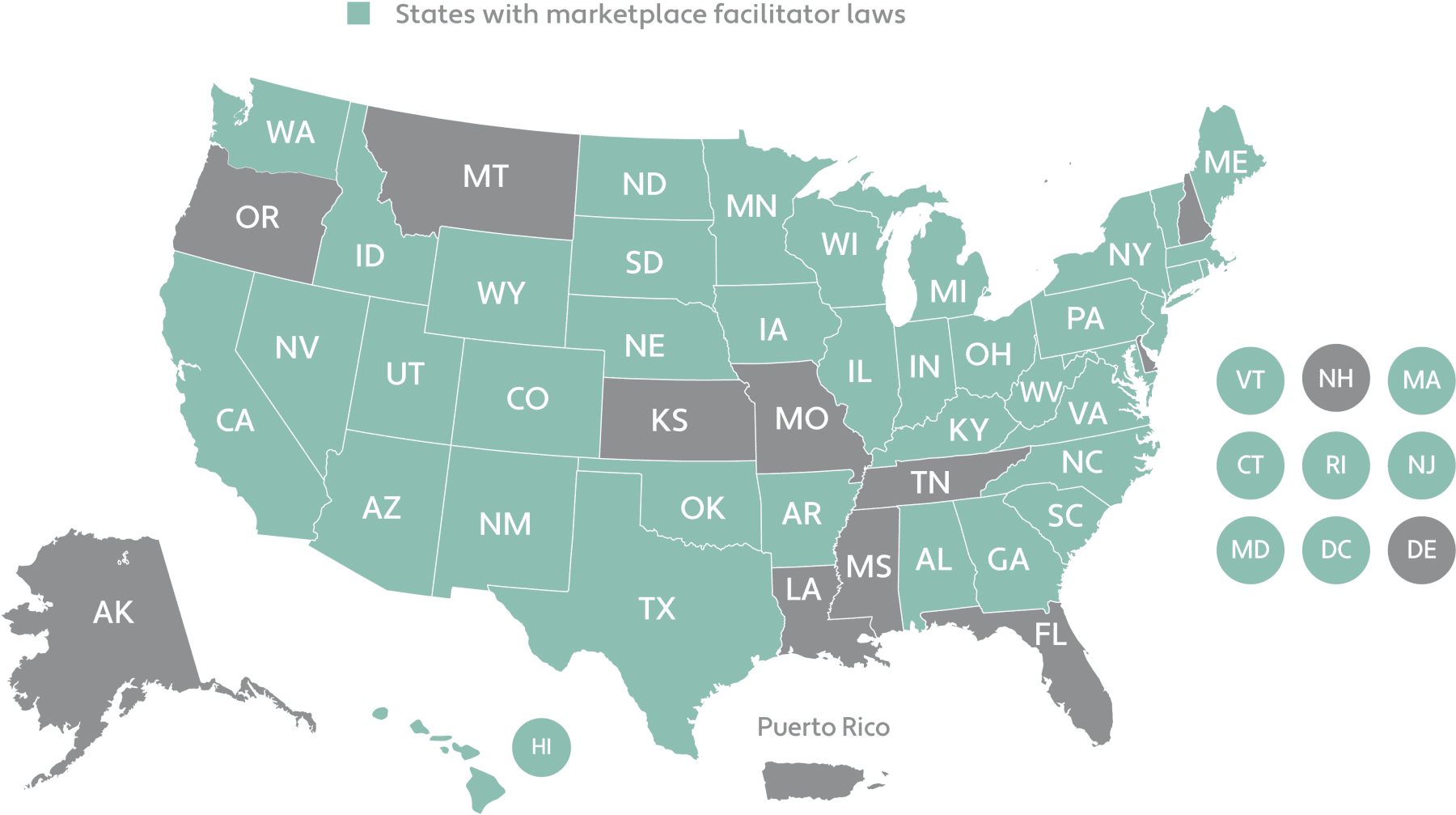

Select the Nebraska city from the list of popular cities below to see its current sales tax rate. The minimum combined 2022 sales tax rate for Nemaha Nebraska is. As of January 1 2019 Nebraska requires certain out-of-state businesses to collect and remit Nebraska sales tax.

You can print a 8 sales tax table here. The Omaha sales tax rate is. Wayfair Inc affect Nebraska.

The December 2020 total local sales tax rate was also 8250. Nebraskas sales tax rate is 55 percent. You can print a 55 sales tax table here.

Ad Lookup Sales Tax Rates For Free. Historical Sales Tax Rates for Nemaha 2022 2021. The Nemaha sales tax rate is.

15 combined rate of 7 Papillion. What is the sales tax rate in Omaha Nebraska. There is no applicable city tax.

Nebraska has 136 seperate areas each with their own Sales Tax rates with the lowest Sales Tax rate in Nebraska being 55 and the highest Sales Tax rate in Nebraska at 75. 2020 Net Taxable Sales. In May 2019 the number of properties that received a foreclosure filing in Omaha NE was 7 lower than the previous month and 80 lower than the same time last year.

2020 Sales Tax 55. Nemaha NE Sales Tax Rate The current total local sales tax rate in Nemaha NE is 5500. 55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021.

Nebraska has recent rate changes Thu Jul 01 2021. The Nebraska state sales and use tax rate is 55 055. Interactive Tax Map Unlimited Use.

The Nebraska state sales tax rate is 55 and the average NE sales tax after local surtaxes is 68. Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective July 1 2022 Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective April 1 2022. 15 combined rate.

The Nebraska sales tax rate is currently. Wayfair Inc affect Nebraska. The December 2020 total local sales tax rate was also 7000.

2019 Sales Tax 55. For tax rates in other cities see Georgia sales taxes by city and county. 2 lower than the maximum sales tax in NE The 55 sales tax rate in Nemaha consists of 55 Nebraska state sales tax.

What is the sales tax rate in Nemaha Nebraska. Nebraska Tax Rate Chronologies Jurisdiction Effective Date Rate Jurisdiction Effective Date Rate Jurisdiction Effective Date Rate Table 5 Local Sales Tax Rates Continued Rushville 0401201515 1001198210 St. The state sales tax rate in Nebraska is 55 but you can customize this table as needed.

The latest sales tax rate for Omaha TX. Visit the Avalara Nebraska state guide to learn more about sales and use tax in Nebraska. 15 combined rate of 7 Local sales and use tax rate increase.

There is no applicable county tax city tax or special tax. For tax rates in other cities see Nebraska sales taxes by city and county. Did South Dakota v.

AP Republican gubernatorial challenger Tim James on Wednesday called for a repeal of Alabamas 2019 gas tax. Sales tax rates rules and regulations change frequently. Paul 10012000 10 Sargent 04012019 20 0401201315 0101200710.

How Does Sales Tax in Omaha compare to the rest of Nebraska. 68022 68101 68102. The Omaha Sales Tax is collected by the merchant on all qualifying sales made within Omaha Groceries are exempt from the Omaha and Nebraska state sales taxes.

New local sales and use tax. You can print a 7 sales tax table here. There is no applicable county tax or special tax.

The Nebraska state sales and use tax rate is 55 055. With local taxes the total sales tax rate is between 5500 and 8000. Omaha NE Sales Tax Rate Omaha NE Sales Tax Rate The current total local sales tax rate in Omaha NE is 7000.

2019 Net Taxable Sales. For tax rates in other cities see Nebraska sales taxes by city and county. Higher sales tax than 68 of Nebraska localities 05 lower than the maximum sales tax in NE The 7 sales tax rate in Omaha consists of 55 Nebraska state sales tax and 15 Omaha tax.

The County sales tax rate is. The minimum combined 2022 sales tax rate for Omaha Nebraska is. This rate includes any state county city and local sales taxes.

There is no applicable special tax. Omaha is in the following zip codes. Nebraska NE Sales Tax Rates by City The state sales tax rate in Nebraska is 5500.

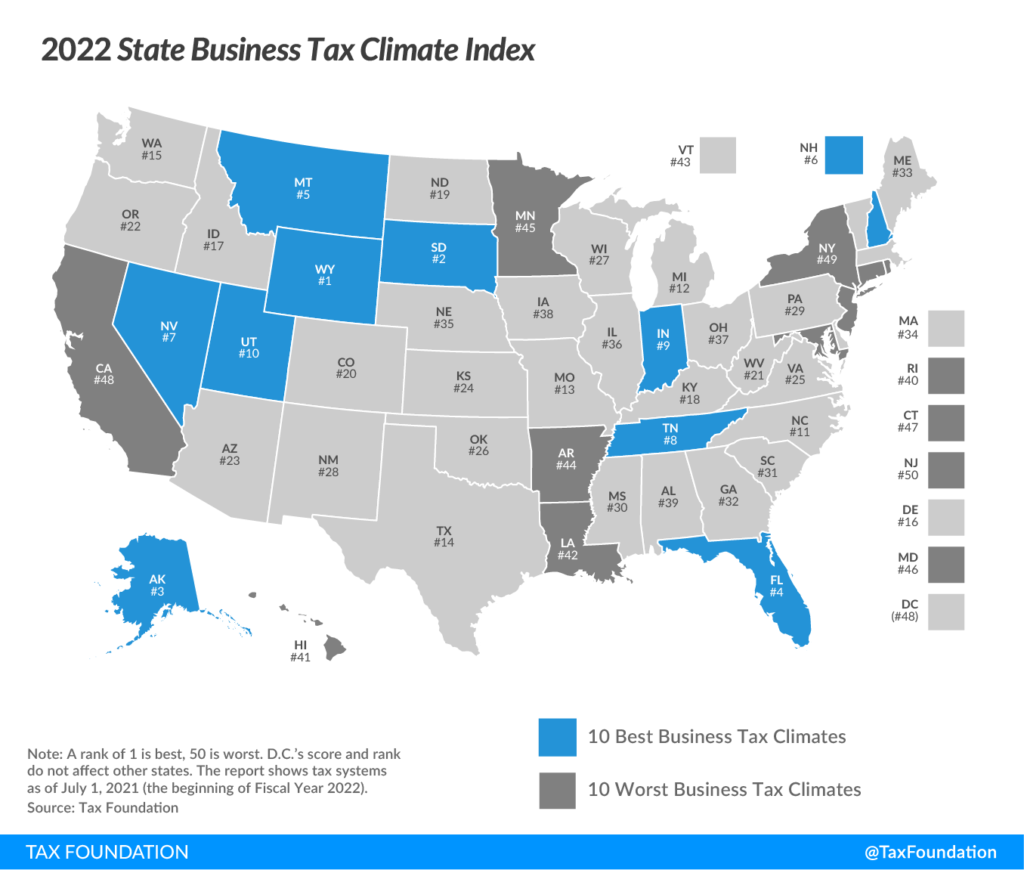

Nebraska Drops To 35th In National Tax Ranking

Sales Taxes In The United States Wikiwand

How To Avoid Estate Taxes With A Trust

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Sales Tax On Cars And Vehicles In Nebraska

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

Sales Taxes In The United States Wikiwand

Amazon Sales Tax For Sellers In 2021

New Ag Census Shows Disparities In Property Taxes By State